The dividend yield is a financial ratio (dividend/price) expressed as a percentage, and is distinct from the dividend itself. It’s important for investors to keep in mind that dividend yields are in constant flux. This is because a given stock’s dividend yield relies not only on the price of the projected dividend but also on the company’s current share price.

How to calculate dividend payout – dividend example

This is referred to as a “pass-through” process, and it means that the company doesn’t have to pay income taxes on profits that it distributes as dividends. Before we jump into looking at the dividend yield, let’s briefly explore dividends. Dividends are payments made by a corporation to its shareholders, usually derived from the company’s profits. These payments represent a the balance sheet portion of the company’s earnings that is distributed to its investors as a reward for their ownership. Conversely, another thing companies can do to reward shareholders is buy back stock, a move that’s designed to raise share prices. If a company does that without raising the dividend, the yield could go down even as investors are smiling over the gains in their portfolios.

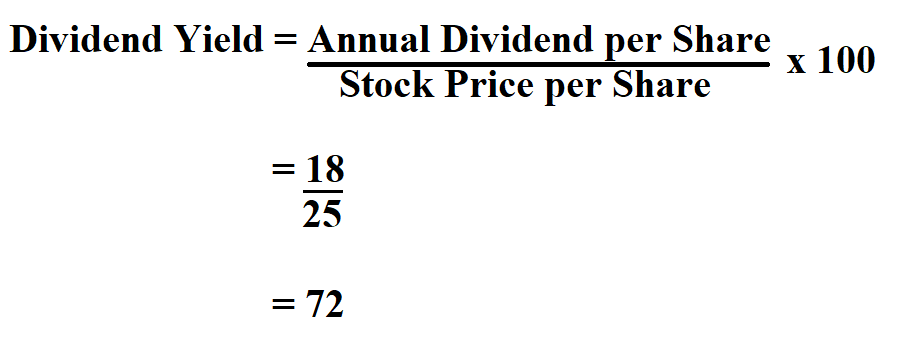

How to calculate dividend yield? – Dividend yield formula

• From a valuation perspective, dividend yield can be a useful point of comparison. If a company’s dividend yield is substantially different from its industry peers, or from the company’s own typical levels, that can be an indicator of whether the company is trading at the right valuation. Dividend investing is one of the famous investing strategies that focuses on getting dividends as returns instead of capital gains. Suppose we have two companies – Company A and Company B – each trading at $100.00 with an annual dividend per share (DPS) of $2.00 in Year 1. However, considering companies are reluctant to cut dividends once implemented, a public announcement that the current dividend payout will be cut is practically always perceived negatively by the market.

Using the MarketBeat Dividend Yield Calculator

Alternatively, to take into account changing dividends, an investor can add up all the dividend payments over the prior year. The first step in calculating dividend yield is to determine the annual dividend. There are several different methods for estimating the dividend per share of a company for a current year.

How to Calculate Annual Dividends

For instance, rapid changes in a stock price can distort the dividend yield. And analyses of a company’s historical performance can only tell you so much about the future. Some investors prefer a measure called the dividend payout ratio to analyze what might happen going forward. A stock dividend, or dividend for short, is a payment made by a company to its shareholders.

- In such cases, instead of getting dividends from the company, it automatically gets reinvested into more shares, hence the other name of our tool – the DRIP calculator.

- To see all exchange delays and terms of use please see Barchart’s disclaimer.

- The dividend policy can therefore provide insights into a company’s financial health and management’s confidence in future earnings.

- In most stock markets – including the United States and European Union – dividends are usually paid out every quarter to coincide with fiscal quarters.

- Company ABC and Company PQR are valued at $5 billion, half of which comes from 25 million publicly held shares worth $100 each.

The current yield is the ratio of the annual dividend to the current market price, which will vary over time. Typically, it is large, established companies with steady profits which pay dividends. Companies paying dividends are often in the financial, energy, healthcare, pharmaceuticals, telecommunication, consumer goods, information technology, real estate, and utility sectors. A dividend can be understood as a payment made by a company to its shareholders as a form of return for investing in the business.

In general, mature companies that aren’t growing very quickly pay the highest dividend yields. Different companies have different priorities when it comes to distributing profits to shareholders. But if you’re looking for the highest available dividend yield, you can check out NerdWallet’s list of high-dividend stocks. Therefore, the company’s dividend yield is calculated as 0.32 divided by 101 for a dividend yield that rounds up to 0.32%. The other, more important, implication when reinvesting is that dividends are compounding, meaning they are added back to the initial invested amount. In simple terms, it means that if you use your dividends to buy even more shares, you will receive a greater amount the next time your dividend pays out because you have more shares, and so on.

It tells you how much return you are getting as dividends by investing in the stock. Being one of the two main sources of returns for investing in the stock market, it would be unwise for you to neglect the returns from dividends. A yield trap is when a stock’s high dividend yield doesn’t offer any advantages. This can be due to multiple factors, but one way it happens is if a company’s stock price falls faster than its earnings. The falling share price could make the company’s dividend payouts appear more lucrative than they actually are since the company’s failing earnings might also mean the company will soon cut its dividend.

If a quality stock is yielding a high dividend, then it is considered as undervalued. Improvement of sales and profit figures are one of the strongest fundamental indicators of quality stocks. An ideal situation from an investor’s perspective will be high profitability and low debt. Normally, in developing countries, such a situation is not easily available, and most companies are keen on leveraging the high amount of debts on their balance sheets. Let us understand how high dividend yield stocks pay their investors every year in detail with the help of a couple of examples.

For example, if a company has a $20 share price and pays a dividend of $1 per year, its dividend yield would be 5%. If a company’s dividend yield has been steadily increasing, this could be because they are increasing their dividend, because their share price is declining, or both. Depending on the circumstances, this may be seen as either a positive or a negative sign by investors. High dividend yields may be attractive, but they may also come at the expense of the potential growth of the company.